Corporate Governance

Report

To ensure that we engage in fair and sincere business activities as set forth in the Basic Policy on Sustainability, we believe that enhancing our corporate governance is essential. By establishing a corporate governance system and advancing activities based on our management philosophy and the Unipres Group Code of Conduct, we aim to build trusting relationships with our stakeholders on the way to achieving sustained growth.

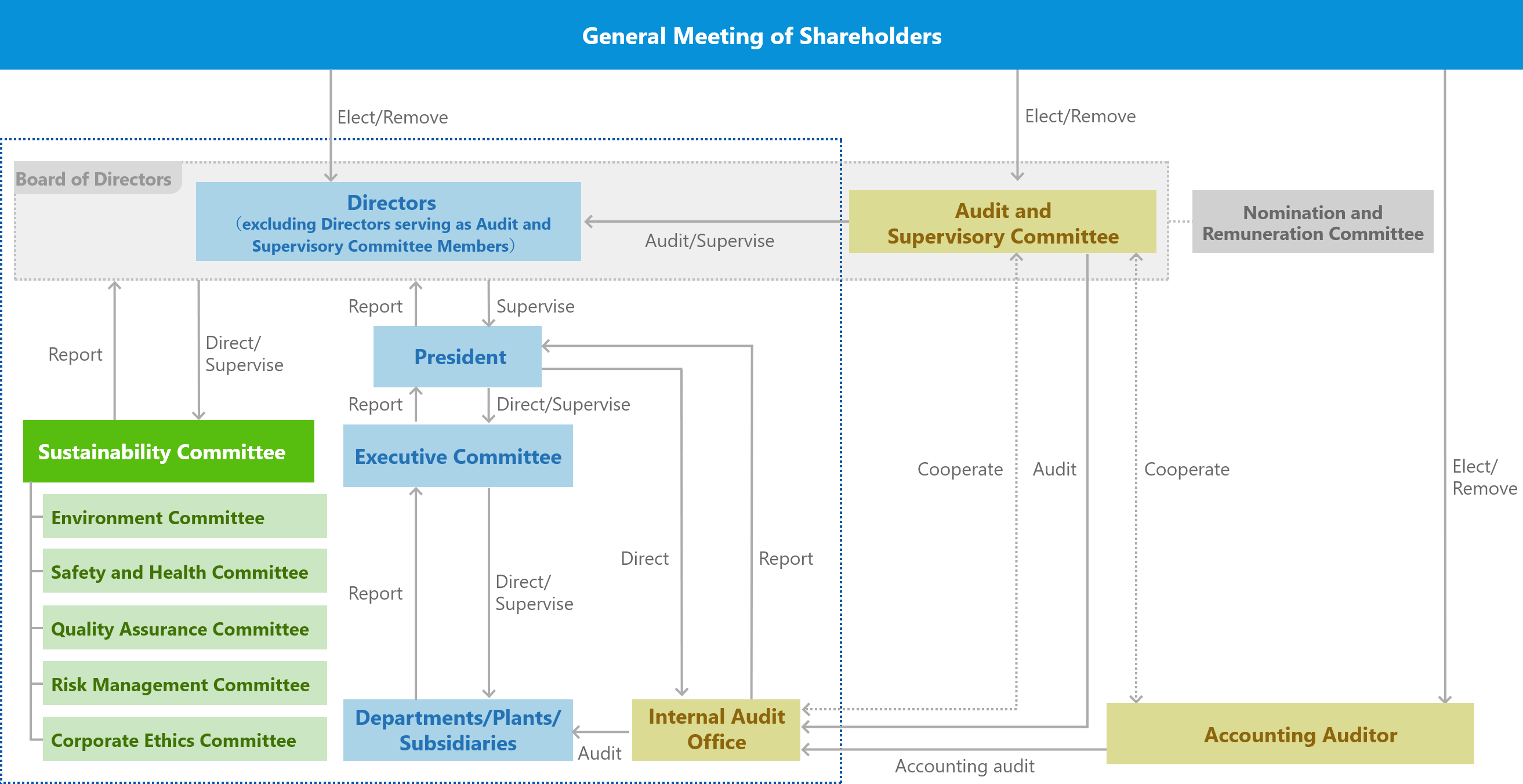

The Board of Directors is the decision-making body for important matters relating to the execution of business by the Company, and it supervises the execution of duties by directors. To enhance the transparency in the management process, independent outside directors are elected. The proportion of independent outside directors in the Board of Directors is set at one-third or more.

We expect our Member of the Board to have the following skills: The percentage of women on the Board of Directors is 28.6% (two of the seven directors).

| Name | Planning/ Management |

Financial Accounting |

Legal Affairs/ Compliance |

Technology/ Development |

Manufacturing/ Quality |

Sales/ Purchasing |

Environment/ Safety |

Governance/ Risk Management |

Global |

|---|---|---|---|---|---|---|---|---|---|

| Nobuya Uranishi |

○ | ○ | ○ | ○ | ○ | ||||

| Yukihiko Morita |

○ | ○ | ○ | ||||||

| Kunio Yamamoto |

○ | ○ | ○ | ○ | |||||

|

Kiyoshi Doi

Outside

Independent

|

○ | ○ | ○ | ○ | |||||

| Shigeto Ito |

○ | ○ | ○ | ○ | |||||

|

Hiroko Yoshiba

Outside

Independent

Female

|

○ | ○ | |||||||

|

Sonoe Hasegawa

Outside

Independent

Female

|

○ | ○ |

The Audit and Supervisory Committee consists of three members, two of whom are independent outside members of the board. The Committee serves as an independent body entrusted by shareholders to audit the execution of duties by members of the board. The full-time member of the Audit and Supervisory Committee conducts internal control system audits and departmental audits based on the annual audit plan, and holds Q&A sessions on the audit results with the other Committee members before discussing the results with the representative directors.

The Nomination and Remuneration Committee serves as an advisory body to the Board of Directors and is composed of a total of three members: one inside director and two independent outside members of the board, meaning independent outside members of the board make up the majority. Based on consultations with the Board of Directors, the Committee deliberates on the nomination and remuneration of directors and submits its recommendations to the Board of Directors.

The Executive Committee, chaired by the president, is composed of executive officers selected by the Board of Directors. The Committee confirms policies concerning the execution of business based on decisions made by the Board of Directors and monitors the progress of business execution. The Executive Committee deliberates on matters relating to business plans and capital investment, as well as important matters relating to organizational and personnel issues, and makes reports and proposals to the Board of Directors as appropriate. A full-time director who is also a member of the Audit and Supervisory Committee attends Executive Committee meetings as an observer.

The Sustainability Committee, chaired by the president, is composed of executive officers selected by the Board of Directors. Under the supervision of the Board of Directors, the Committee deliberates on materiality (key issues) and medium- and long-term goals to address these issues, and reports and make proposals to the Board of Directors, as appropriate, concerning policies, targets, action plans, progress, and achievements relating to sustainability, including internal control. A full-time member of the board who is also a member of the Audit and Supervisory Committee attends Sustainability Committee meetings as an observer.

Five specialist committees have been established under the Sustainability Committee to focus on five separate areas: the Environment Committee, Safety and Health Committee, Quality Assurance Committee, Risk Management Committee, and Corporate Ethics Committee.

The Audit and Supervisory Committee, the Accounting Auditor, and the internal audit division hold regular meetings to ensure close coordination, including working to ensure a consistent approach to key auditing considerations and auditing-related issues that need to be addressed.

In order to promote sustainability management and internal control, the Unipres Group puts in place the necessary systems and other measures for appropriate management to minimize the impact of risks when they become a reality. In doing so, we define risk as the possibility of occurrence of events that prevent Unipres and its subsidiaries from achieving their management policies, and anticipate various risks related to the management of Unipres and its subsidiaries.

The Unipres Group has established the Risk Management Committee under the Sustainability Committee to promote company-wide risk management. The Risk Management Committee reviews and discusses risk management related policies, targets, action plans, progress, and performance, and reports and makes proposals to the Board of Directors and the Sustainability Committee. The Risk Management Committee is chaired by the executive officer in charge of corporate planning, appointed by the chair of the Sustainability Committee, and it also consists of two vice chairs (the executive officer in charge of technology and the executive officer in charge of general affairs) and three members (the department head in charge of corporate planning, the department head in charge of technology planning and strategy, and the department head in charge of general affairs). In addition, a full-time Audit and Supervisory Committee member also attends Committee meetings as an observer.

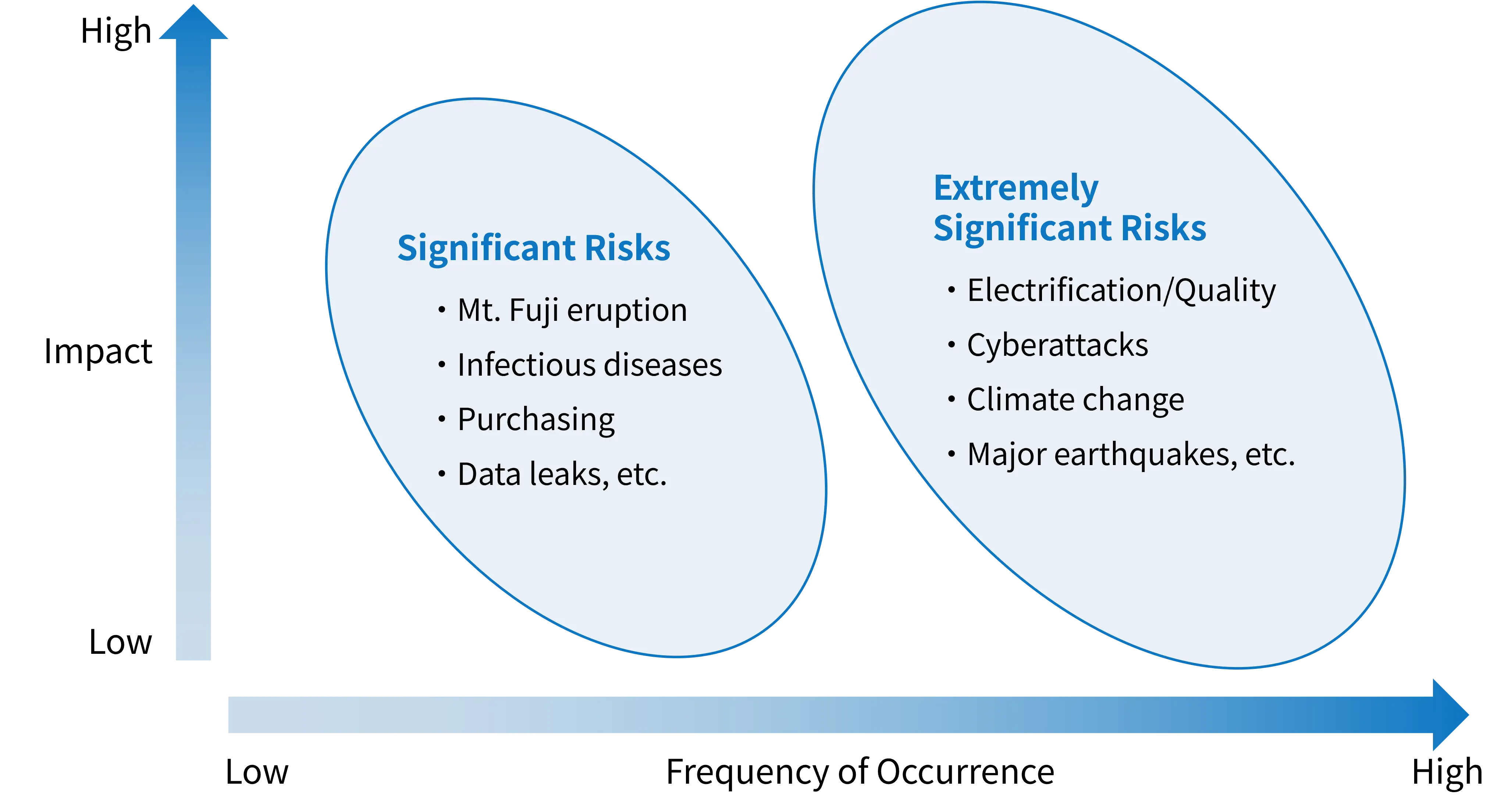

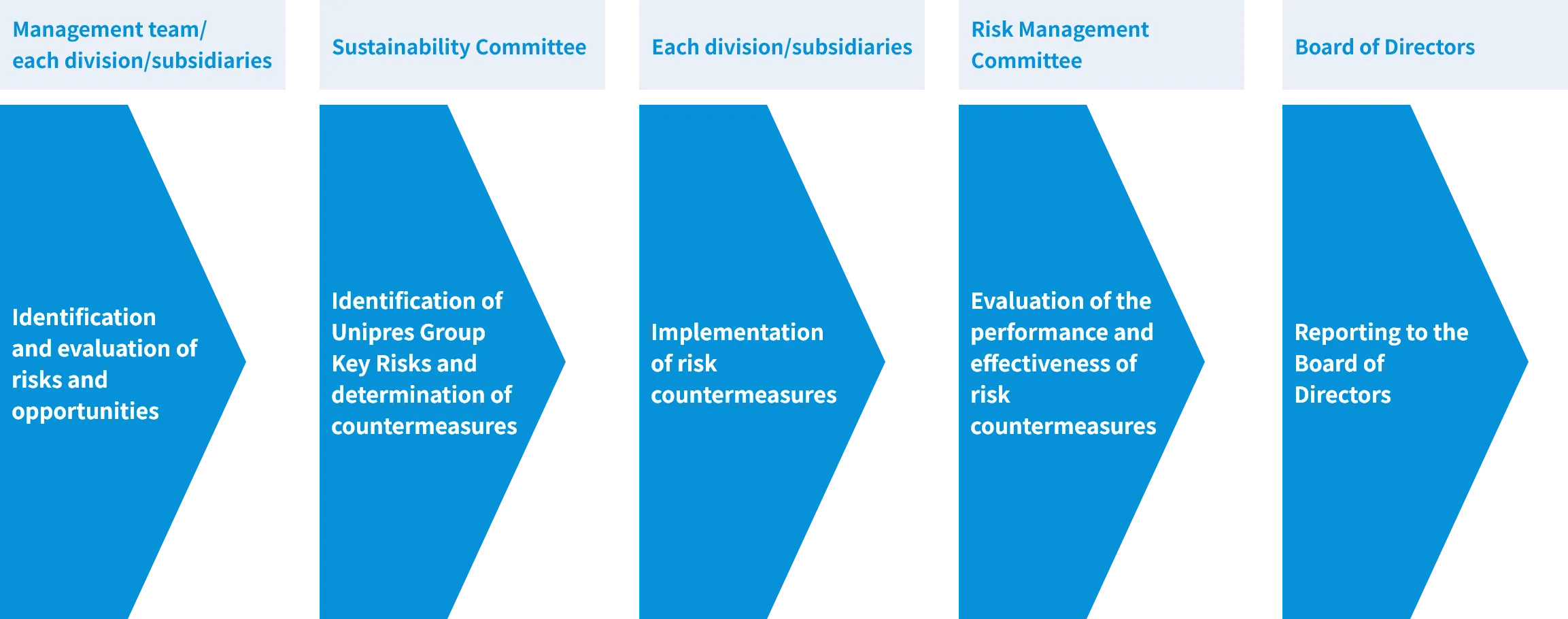

To address the diversifying range of risks that Unipres Group faces, we identify risks that require particularly focused attention as Unipres Group Key Risks and conduct risk reduction activities. The process used to identify Unipres Group Key Risks is as follows.

(i) Conduct interviews with management team members and have all divisions of the Company and its domestic subsidiaries perform risk assessments in order to prepare a list of potential risks.

(ii) Arrange these risks on a risk map in accordance with their potential impact and frequency of occurrence to ascertain and analyze their relative significance.

(iii) Based on the analysis results, identify the Unipres Group Key Risks.

Key risks currently identified for the Unipres Group include electrification/quality, a major Nankai Trough earthquake, and cyberattacks.

The Sustainability Committee deliberates on and approves the risk identification process, risk reduction activities, and the effectiveness evaluation of risk reduction activities, and reports its findings regularly to the Board of Directors.

At the Unipres Group, we have formulated the Unipres Group Information Security Policy to appropriately manage and protect information assets obtained through our business activities. We are working to constantly strengthen our security by establishing an information security system. In addition, we have been proactively responding to the recent increase in cyberattacks through improvements (strengthening detection and prevention, training for responding to information security incidents, and employee education) based on the industry standard, JAMA/JAPIA Cybersecurity Guidelines.

Our measures to counter anticipated risks from possible large-scale natural disasters include (1) developing a BCP, (2) installing seismic reinforcement, and (3) deploying emergency supplies, etc. Through this, we are taking action to ensure that any impact on our business is kept to a minimum.

In order to set the compliance with laws and regulations and social ethics as the foundation of our corporate activities, we have established the Unipres Group Code of Conduct, the spirit of which is communicated to all officers and employees by the President.

The Unipres Group established the Corporate Ethics Committee under the Sustainability Committee to carry out its activities to promote compliance throughout the Unipres Group. In order to promote sustainability management and internal control, the Corporate Ethics Committee reviews and discusses compliance- and human rights-related policies, targets, action plans, progress and performance, and makes reports and proposals to the Board of Directors and the Sustainability Committee. The Corporate Ethics Committee is chaired by the Executive Officer in charge of sales and purchasing, as appointed by the chair of the Sustainability Committee. The other Committee members consist of one vice chair (executive officers in charge of general affairs resources) and 12 members (department heads for human resources, general affairs, accounting, sales, purchasing, technology planning and strategy, manufacturing, production engineering, and internal audit). In addition, a full-time Audit and Supervisory Committee member attends Committee meetings as an observer.

The Unipres Group aims to "build a trust-based relationship with our stakeholders by fair and sincere business activities," in line with our management philosophy of "Achieve Sustainability Management." In order to achieve this philosophy, we believe that it is essential for all officers and employees of the Unipres Group to comply with not only national and international laws and regulations as well as internal rules, but also social norms in their daily activities, and to act in a sensible and responsible manner, in both their public and private activities. We have established the Unipres Group Code of Conduct, coupled with the Unipres Group Code of Conduct Guidebook (instructions) based on this belief, so that the Group as a whole works to further ensure compliance.

The Unipres Group Code of Conduct and the Unipres Group Code of Conduct Guidebook are reviewed annually by the Corporate Ethics Committee. If revisions are required, changes to the Unipres Group Code of Conduct will be approved by the Board of Directors, while changes to the Unipres Group Code of Conduct Guidebook will be approved by the Sustainability Committee.

<Compliance Self-Check>

As part of the training based on the Unipres Group Code of Conduct, we provide annual compliance self-checking for all officers and employees. A survey is conducted to verify the effects of the training, with the results reported to the Board of Directors. In FY2024, a total of 20 Unipres Group companies (6 in Japan and 14 overseas) implemented the program, with a total of 7,518 employees (2,958 in Japan and 4,560 overseas) participating in the training.

<Functional Axis/Rank-Specific Education>

To further deepen understanding of the Unipres Group Code of Conduct, we have been offering functional axis-specific education, in which more specialized content has been developed for the departments that require it, as well as rank-specific education for managers and supervisors, since FY2023.

In accordance with the Unipres Group Code of Conduct and various policies, the Unipres Group officers and employees are committed to preventing all kinds of corrupt practices, including bribery, conflicts of interest, anti-competitive practices, and insider trading. In FY2024, no employee was punished or dismissed for violating the Unipres Group Code of Conduct with regard to anti-corruption or the Basic Anti-Corruption Policy.

UNIPRES CORPORATION and its subsidiaries (hereinafter referred to as "UNIPRES Corporate Group") and their officers and employees (including contract employees, part-time workers and temporary workers that are not regular company employees. Hereinafter referred to as "Employees") shall comply with the anti-corruption-related laws and ordinances that apply to UNIPRES Corporate Group companies and this Basic Anti-Corruption Policy (hereinafter referred to as "the Policy.").

The UNIPRES Corporate Group and the Employees shall not under any circumstances provide, or offer or promise to provide benefits including money, gifts, entertainment or travel to public officials or members of the private sector (natural people and corporations) for the purpose of obtaining unjust business benefits. However, entertainment, gifts and travel are allowed only if the purpose and amount of money, etc. conform to applicable laws and regulations, do not violate the Unipres Group Code of Conduct (including national Code of Conduct Guide Books), and are within the appropriate range according to social norms. The UNIPRES Corporate Group and the Employees shall not under any circumstances receive, or require or promise to receive money, gifts, entertainment, travel or any other benefits from third parties intending to conduct business with UNIPRES Corporate Group. However, this shall be allowed if the purpose and amount of money, etc. conform to applicable laws and regulations, do not violate the Unipres Group Code of Conduct (including national Code of Conduct Guide Books), and are within the appropriate range according to social norms.

Even small payments (so-called "facilitation payments") to facilitate procedures for ordinary administrative services can be bribery, and therefore such payments are prohibited.

The UNIPRES Corporate Group requires suppliers, contractors, venders, distributors, external agents, consultants and agents of UNIPRES Corporate Group to comply with the Policy.

Employees shall always report any violation of the Policy to the company through Internal Notification, etc. Under the Internal Notification Rules of UNIPRES Corporate Group companies, disadvantageous acts against reporting of violations are strictly prohibited.

Employees shall comply with laws and internal rules, perform appropriate accounting treatment to ensure the accuracy and reliability of financial and tax accounting, keep accurate records, and retain them properly.

The taxes paid by the Unipres Group ("Unipres") play an important economic and social role and are important for the development of the countries and regions in which Unipres operates. The Unipres Code of Conduct sets out the standards of behaviour to which all employees are expected to adhere. This is exactly the same for taxation. Unipres operates with respect for the intentions of the tax system as well as the provisions of the tax code.

Unipres acts in accordance with the laws, regulations and rules relating to taxation in the countries and territories in which it operates and follows the relevant international standards (e.g. OECD guidelines). Unipres Group is committed to understanding these regulations and codes of conduct, and to ensuring the proper payment of taxes in each country.

As multinational companies are increasingly concerned about their tax policies, Unipres will disclose tax-related information in accordance with the relevant legislation and disclosure standards in each country.

Unipres is committed to ensuring that the value created through its business activities is appropriately taxed according to the country and region in which it operates. Transfer pricing is conducted in compliance with the OECD Transfer Pricing Guidelines and other countries' transfer pricing taxation systems and related regulations, by appropriately applying transfer pricing calculation methods based on functional risk analysis, determining transaction prices between Group companies, and preparing transfer pricing documentation. In addition, the bilateral Advance Pricing Agreements "APA", based on tax treaties, allow the tax authorities of the two countries to agree in advance and to clarify the long-term tax position.

Unipres does not plan nor carry out deliberate tax avoidance activities that have no real business actualities. Unipres pays taxes properly based on transactions that are in line with the actual business situation.

Unipres is committed to building and maintaining constructive and mutually respectful relationships with governments and tax authorities through the timely and appropriate submission of tax information. Unipres is committed to filing and paying taxes in a timely manner in accordance with the relevant laws and regulations of each country, and to responding appropriately to requests for information disclosure from tax authorities.

The Unipres Group promotes company-wide anti-bribery and anti-corruption initiatives, and as in the case of compliance, the Corporate Ethics Committee reviews targets and action plans.

We assess and analyze risks involving matters related to anti-corruption efforts every year. Our e-learning training (compliance self-check) deals with the subject of anticorruption in line with this assessment and analysis in order to raise employees' awareness through education. In addition, anti-corruption-specific training was initiated at Unipres in FY2023. It is also available to domestic subsidiaries since FY2024.

We have added items pertaining to anti-bribery and anti-corruption to the check list we use for legal due diligence on an alliance partner in whom we have a stake.